Every field, like tech, healthcare, or automobile, grows, and so does the MFD Business! In the FY 2025, the Mutual Fund industry has seen a huge jump in fresh energy.

According to Cafemutual:

- 29,555 more Mutual Fund Distributors joined the industry.

- Close to 1 Crore new investors started their mutual fund investing journey

Now that’s massive! But here’s the real question: How are these new MFDs going to manage so many new investors?

After all, investors today are tech-savvy, busy, and expect everything to happen fast. That’s where the old-school way of managing clients just doesn’t work anymore.

Hard Work isn’t Enough, You Also Need The Right Tools

You might be hard-working, no doubt. But in 2025, just hard work isn’t enough. You need:

- Smart systems

- Speedy processes

- Zero paperwork headaches

This is where mutual fund software becomes your best business partner.

How Software Helps MFDs Work Smarter, Not Harder

Let’s break it down — what does a Mutual Fund Distributor need to do daily? Onboard clients. Make investments. Communicate updates. Send alerts. Track growth. Now, for one second, just imagine doing all of this manually… every single day.

Here’s how software solves all of it for you:

Smooth and Paperless Investor Onboarding

Manual onboarding means:

- Chasing clients for documents

- Filling forms by hand

- Sending files back and forth

Software makes onboarding:

- 100% paperless

- KYC done online

- Documents uploaded through mobile

- Approval via OTP, email, or WhatsApp

Result? You can onboard multiple clients a day, not just 1 or 2.

Easy Investment Execution in Minutes

Placing SIPs, redemptions, switches — it’s all part of daily MFD work.

Without software?

- You’ll need to visit the AMC portals

- Handle Excel sheets

- Risk of missing something important

With NSE/ BSE and MFU integrated software:

- Place orders directly from the dashboard

- Transact in SIPs, STPs, SWPs, and redeem with a click

- Track transactions in real time

- Let clients approve via WhatsApp or email

No more manual errors, delays, or frustration.

Share Portfolio Reports with a Click

Investors want updates. And if you can’t give them timely reports, they’ll feel ignored. Manually sending reports = hours of copying, pasting, and emailing.

With the right software, you can:

- Share reports monthly on WhatsApp or email

- Auto-generate capital gain/loss statements

- Send portfolio performance with charts

This keeps your investors informed — and builds trust fast.

Set Automatic Alerts and Reminders

Forget manually reminding clients about:

- SIP dues

- Life insurance renewals

- Maturity dates

- Policy lapses

Software does it all automatically:

- Sends due reminders

- Share maturity alerts

- Sends birthday or anniversary wishes too!

Clients feel cared for. You save time. Win-win.

Want to Grow Faster? Here's How Software Helps You Expand

It’s not just about handling daily tasks — it’s also about scaling your business. Here’s how software helps you grow:

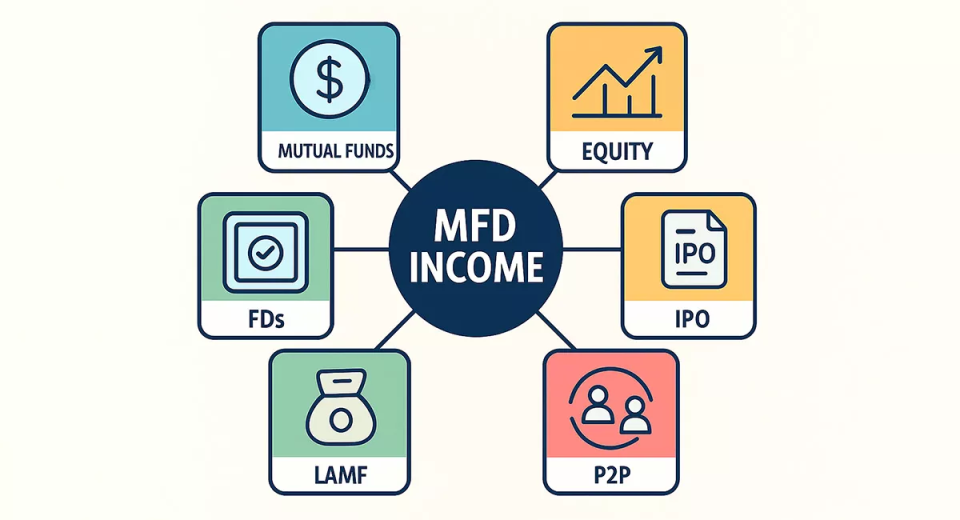

Offer Multiple Asset Classes — Not Just Mutual Funds

Clients want more than SIPs now. They want:

- Fixed Deposits

- Equity investments

- IPOs

- Loan Against Mutual Funds (LAMF)

- P2P, NPS, and more

With the right software, you can offer all of these from a single platform. More offerings = more clients = higher AUM.

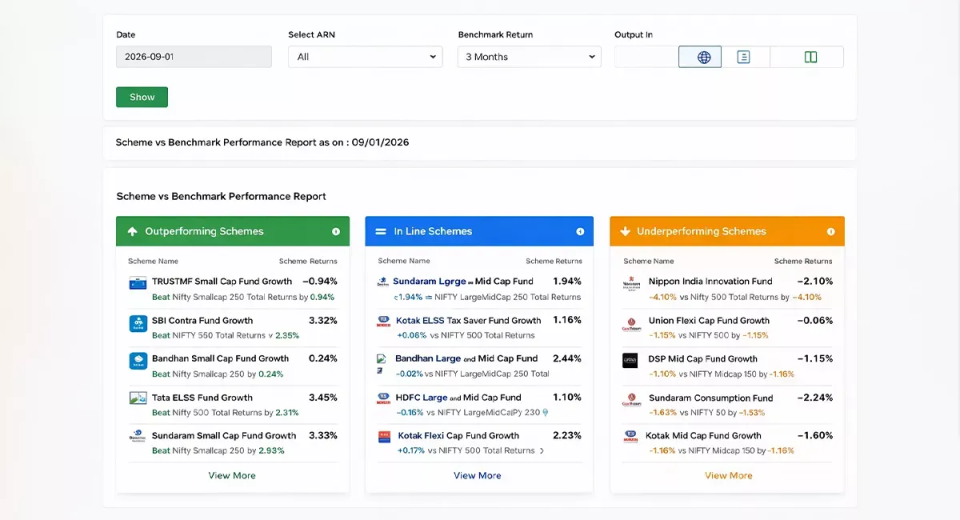

Tools That Make You Look Smarter

Supporting clients is easier when you have the right tools. Software gives you:

- SIP Calculators

- Step-up SIP tools

- Retirement planning calculators

- Goal GPS

- Portfolio rebalancing tools

With tools like these, you’ll always sound smart and data-backed, not just opinion-based.

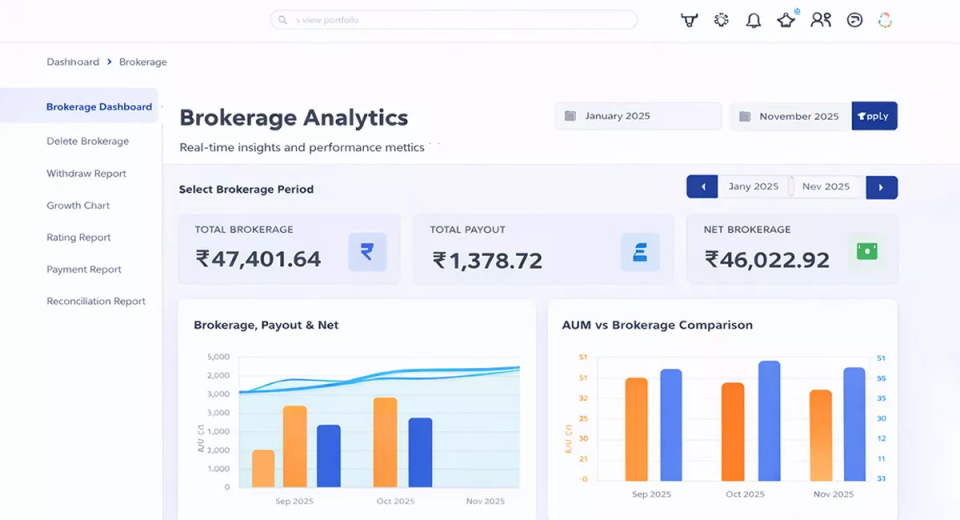

Track Year-on-Year AUM Growth

You can’t grow what you don’t track. Software helps you monitor:

- Your AUM growth each year

- Top-performing clients

- Client-wise, scheme-wise reports.

This helps you set better goals, plan smarter strategies, and see real progress.

What Happens If You Don’t Use Tech?

Let’s say you don’t invest in mutual fund software for distributors. What could go wrong?

-

You’ll waste hours on manual work

-

Clients may leave because of delays

-

You can’t scale beyond a few dozen investors

-

No insights into growth or portfolio trends

-

You lose to competitors who are tech-enabled

In short: Your business may start, but it won’t scale.

Real Talk: Are You Ready to Grow or Just Survive?

Let’s ask you something:

- Are you still using Excel and WhatsApp as your main tools?

- Do you feel overwhelmed with tasks?

- Do you wish your clients got faster updates?

If you said yes, it’s time to switch. Because 29.5K other MFDs just entered the same market as you. And your clients have hundreds of choices. So what makes you stand out? Tech does.

Final Words: Don’t Just Be in the Business — Lead It

In 2025, investors want faster service, better communication, and multi-product solutions. You want to save time, serve better, and grow faster. The bridge between the two? A powerful software.

So if you’re one of the new MFDs in the game — or even an experienced one feeling stuck — it’s time to upgrade. Use tech. Grow fast. Stay ahead. Because in this business, speed and service win — every time.