In a world where finance influencers are gaining millions of followers and grabbing attention with every reel, the ones with real qualifications, Mutual Fund Distributors, are staying behind the scenes.

While finance is seen as a respected and stable career, very few choose to become an MFD. Even those who belong to MFD families often hesitate to carry forward the legacy.

Why does this happen?

- People think it lacks glamour or social visibility

- It feels outdated compared to flashy finance content online

- Misconception that it's just about selling mutual funds

- Paperwork and manual processes scare many away

- Lack of digital presence or personal branding

- Some feel that mutual fund software for distributors in India is too complex to use.

And yet, here’s the real eye-opener: India has over 11 crore mutual fund investors... but only 1.47 lakh active MFDs!

That’s not a small gap. That’s a massive opportunity waiting to be tapped.

Why Being an MFD is a Promising Career Option?

Yes, the field of mutual funds needs more people. But not just anyone, we need qualified, tech-enabled, and client-focused MFDs who can guide investors the right way.

Let’s break down why MFDs matter and how this career is filled with potential:

The Role MFDs Play in India's Financial Growth

- Help investors make informed financial decisions

- Educate people on long-term investing, SIPs and rupee-cost averaging, goal planning, & more.

- Build a trusted relationship with clients over the years

- Create financial awareness at a grassroots level

The Scope is Only Growing

- Investors are growing every year (11 crore and counting!)

- SEBI is focusing on investor education

- Rising income and urbanisation mean more demand for MFDs

- Financial literacy is improving across small towns and cities

Certifications That Give You the Edge

Becoming an MFD isn’t just about passion; it’s about the right knowledge. Two certifications that can boost your career:

1. NISM Series VA - Mutual Fund Distributors Certification

- Mandatory certification to begin as an MFD

- This helps you learn the basics of mutual funds, it’s types, and how to guide investors

2. CFP – Certified Financial Planner

- Internationally recognised certification

- Covers in-depth knowledge of:

- Mutual Funds

- Financial Planning

- Wealth Management

- Goal-Based Planning

With these certifications:

- You gain client trust and credibility

- You can offer holistic financial solutions

- You can plan and offer products and services beyond mutual funds

If You're Still Worried About the Workload? Let Technology Do the Heavy Lifting

Let’s be real, becoming an MFD can truly feel overwhelming without the right tools. That’s exactly why more professionals are choosing mutual fund software for distributors as their technology partner.

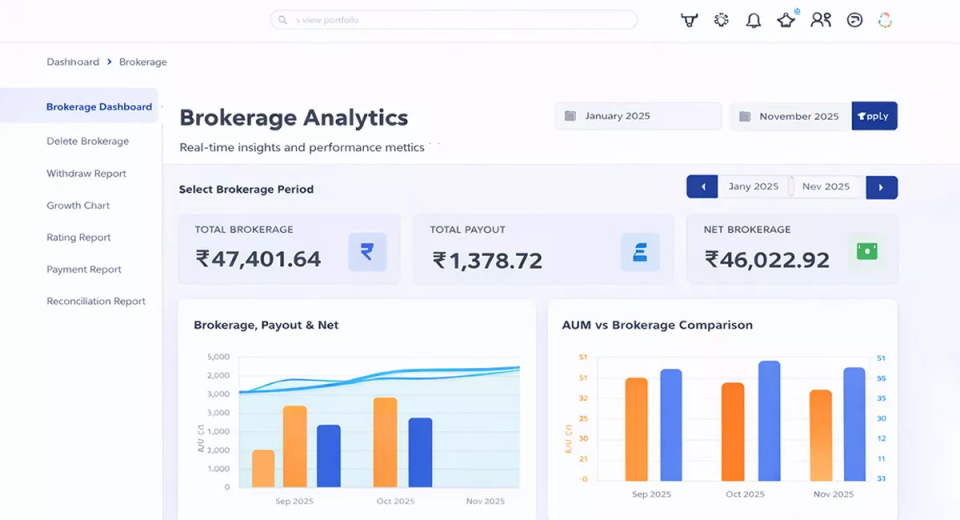

How Back Office Software Makes Life Easier

Gone are the days of piles of paper and spreadsheets. With the right software, you can:

Manage Investors Like a Pro

- Onboard clients digitally in minutes

- Track every investor’s portfolio from one dashboard

- Automate reports, alerts, and compliance updates

Grow Your AUM Smartly

- Get ready-made client insights

- Set alerts for SIP renewals, FD marturity, & more

- Use data to cross-sell and upsell

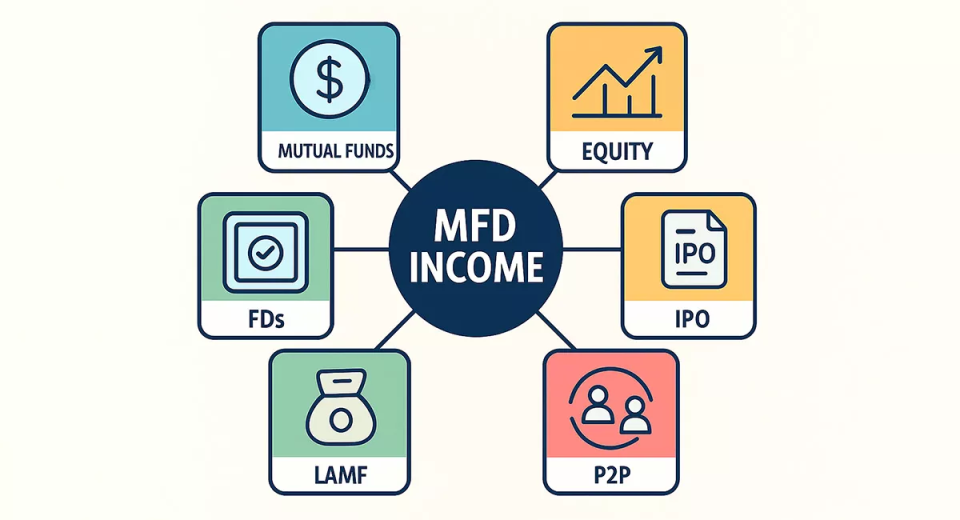

Offer Multi-Asset Products

- Mutual Funds

- Fixed Deposits

- IPOs

- Equity

- Loans Against Mutual Funds

Having more options means:

- More services per client

- Increased trust and retention

- Diversified revenue streams for you

Performance Tracking

- Monitor your own YoY growth

- Set goals and measure progress

- Visual reports to understand your business better

Save Time, Build More Relationships

- Less time on admin tasks

- More time to talk to investors

- Easier to scale without extra manpower

With software doing the backend work, you focus on what really matters – your clients.

But Is It Worth It?

Here’s what most people don’t realise:

- MFDs aren’t just commission agents, they’re financial educators

- You help families achieve life goals, child’s education, retirement, home

- You can earn a stable, recurring income every year

- And more importantly, build a legacy that’s both impactful and profitable

Why More Young People Should Explore This Career

Finance is evolving. Mutual funds are no longer a complicated, elite product. Investors from Tier-2 and Tier-3 cities are actively investing and learning.

So why shouldn’t you be the one guiding them?

- The market is huge, but underserved

- People trust people, not platforms

- Advisors & MFDs will always be in demand

If you are:

- Passionate about finance

- Willing to learn and grow

- Open to using smart tools and technology

Then, mutual fund distribution is not just a career option; it’s a smart move.

Final Words

There’s no shortage of investors. What India needs are more committed and tech-savvy mutual fund distributors.

So whether you’re just starting out, switching careers, or continuing a family legacy, this field needs you.

With the right certifications, the right mindset, and the right mutual fund software for distributors, your career can be impactful, scalable, digital, and future-ready. It’s time to rethink what being an MFD really means. The opportunity is big. The tools are available. The choice is yours.