You’ve spent years building your mutual fund business. The client calls, the paperwork, the late nights—it’s all part of your daily grind. But here’s a question most MFDs don’t ask: what happens to all this hard work when you step away?

Unlike Bollywood, where nepotism often ensures a son or daughter takes over the limelight, real-life businesses aren’t guaranteed to continue in the family. Your children may not naturally want to become Mutual Fund Distributors (MFDs). So, how do you make sure your business continues to thrive—maybe even across generations?

The answer is simple: adapt technology, integrate AI, and use robust mutual fund software. Let’s see how this can turn your business into a lasting family legacy.

Why Many Wealth Management Businesses Don’t Last Beyond the Founder

You might think, “My kids can just take over someday.” But here’s the reality:

- Most young people don’t naturally aspire to become MFDs.

- Manual work and outdated systems make the business less appealing.

- Traditional operations often miss digital trends, losing potential investors.

- Without modern tools, training new family members takes too much time.

- Hard-earned relationships with clients can be hard to maintain without proper systems.

If you want your well-established wealth management business to survive beyond you, you need to innovate and embrace technology.

How Technology Makes Your Business Ready for the Next Generation

Today’s younger generation is digitally savvy. They don’t want stacks of paperwork—they want apps, dashboards, and smart solutions.

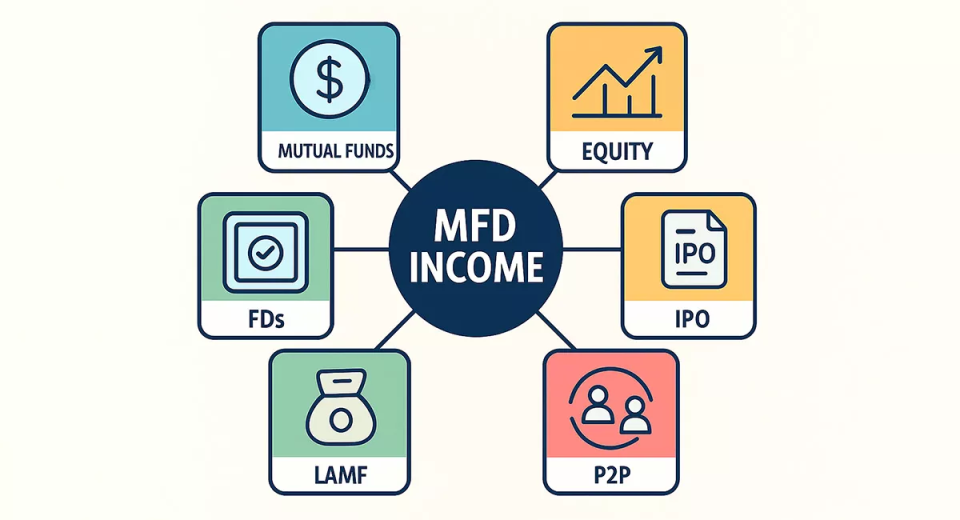

By using mutual fund software for distributors and AI, you can:

- Simplify operations: Automate onboarding, transactions, reports, and client tracking.

- Enhance client experience: Investor portals give clients control and transparency.

- Make training easy: AI insights guide new users to make informed decisions.

- Attract younger family members: A tech-driven business feels modern and exciting.

- Build credibility: Digital tools show investors you are professional and trustworthy.

In short, technology doesn’t just make your work easier; it creates a clear path for your coming generation to take over the business smoothly.

What a Digital Ecosystem Can Do

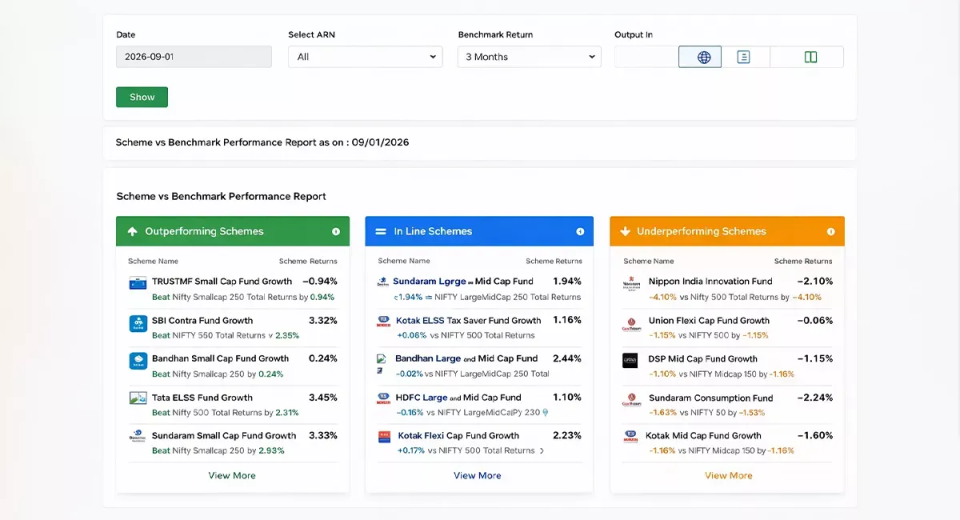

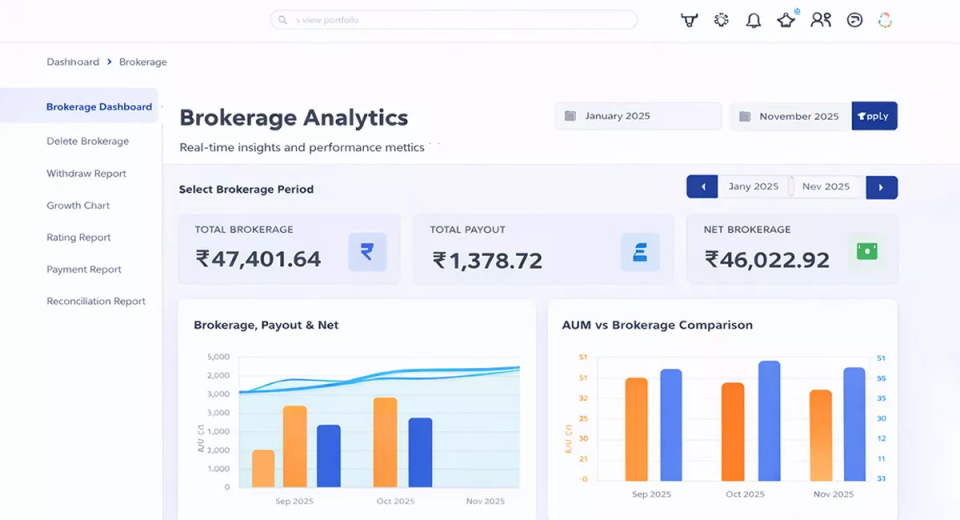

If you’re still using spreadsheets or offline records, you’re missing out. A web-based back office software creates a full ecosystem to manage your business efficiently:

- MFD Mobile App: Track clients, check portfolios, and manage transactions anytime.

- Investor Mobile App: Clients can monitor investments, check returns, and invest online.

- Self-Investment Portal: New or existing investors can start SIPs under your brand.

- AI Insights: 24/7 assistance for portfolio suggestions, compliance updates, and analytics.

- Seamless Integrations: Connect to banks, fund houses, and third-party platforms for smooth operations.

With this ecosystem, your business becomes future-ready, making it easy for anyone in your family to run it.

How Digital Presence Builds Credibility

Great software alone isn’t enough. Investors and potential clients need to see your business as modern and reliable.

- Social Media: Reach investors where they spend most of their time.

- Online Reviews & Testimonials: Build trust through client feedback.

- Digital Campaigns: Target the right audience efficiently.

A strong digital presence boosts investor confidence, making your business more appealing to clients and family successors.

Making the Business Attractive to Young Family Members

Young family members are more likely to join a business that is modern, tech-driven, and easy to work with:

- AI dashboards make investment decisions easy to understand.

- Digital tools reduce manual work, making the business attractive.

- Mobile apps allow them to see real-time results, keeping them engaged.

- Online presence makes the business relevant and exciting.

When the business feels approachable and modern, they’ll not just inherit it—they’ll want to grow it further.

Bringing It All Together: From Business to Legacy

Here’s how all this creates a family legacy:

- Smooth Operations: Processes run without interruption.

- Future-Ready: Technology prepares the business for the next generation.

- Investor Trust: Transparency builds long-term client loyalty.

- Scalability: Manage more clients efficiently.

- Attracts Young Talent: Modern tools make the business interesting for successors.

A mutual fund business that embraces technology doesn’t just survive—it thrives, creating a sustainable path for future generations.

Conclusion

Building a family legacy isn’t about forcing someone to continue your business—it’s about creating a business worth continuing.

By integrating wealth management software, AI insights, and digital tools, you can streamline operations, enhance investor trust, make training easy for successors, and build a tech-driven, attractive business.

Your hard work today can transform into a lasting family legacy tomorrow. By adapting now, you might inspire the next generation not only to take over but also to grow your business to new heights.