There's a popular belief that MFDs earn huge commissions. But just looking at the actual math behind those numbers can make us see a whole different story, one that every MFD must talk about more often.

Here's what the data from FY 2023-24 reveals:

- Total Mutual Fund AUM: ?53.40 lakh crores

- AUM through Direct Plans: ?21.98 lakh crores

- AUM through Regular Plans (via MFDs): ?31.42 lakh crores

- Total Commission Paid to MFDs: ?14,854 crores

- After GST (18%): Net earnings are ?12,180 crores

- Basically, the net cost would be just 0.39% of AUM

Yes, you read that right.

While RIAs charge 0.71% to 1.18%,

MFDs advise, execute, and support at just 0.39%

Despite this, MFDs are often undervalued, underrepresented, and under-credited.

Now, let's talk about how mutual fund software helps you do this job even more efficiently, at scale, and at the lowest cost.

What's Holding MFDs Back?

Let's be honest, most MFDs are wearing multiple hats every single day.

You're:

- Onboarding clients manually

- Sending folio statements on WhatsApp

- Following up with clients one-by-one

- Creating Excel reports every month

- Trying to convince investors to stay long-term

- And still managing compliance, KYC, service calls…

All this takes time, effort, and costs money.

And the worst part? It's not scalable.

This is Where The Best Mutual Fund Software Changes Everything

The best mutual fund software acts like your digital partner, silently running your operations, engaging clients, and helping you grow, while you focus on building relationships.

Here's how it makes your practice super cost-effective:

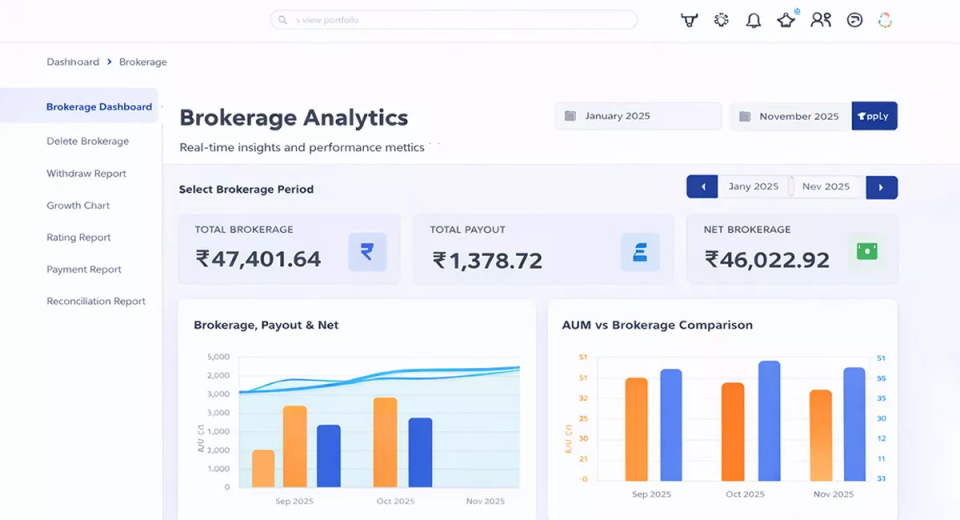

Lower Operational Costs

- No need to hire extra team members

- One dashboard does everything, from onboarding to reporting

- Reduces manual work, paper trails, and courier charges

Time is Money, And You Save Tons of It

- Automates client communication: reports, alerts, reminders

- Built-in goal tracking and portfolio health checks

- Saves your precious hours every day, across 100s of clients

Scale Without Increasing Cost

- Whether you manage ?5 crore or ?50 crore, your backend cost remains the same

- You don't need multiple tools because everything is integrated

- You can grow your AUM without increasing your office expenses

Better Investor Experience

- Investors get mobile apps to track investments 24/7

- Everything looks professional and branded - it builds credibility

- Faster queries, better engagement = higher trust

Increase Revenue Without Charging More

- Convert more leads with digital onboarding

- Retain investors for longer through better servicing

- Upsell with automated suggestions and real-time dashboards

And you achieve all this while staying within that 0.39% cost range.

Let's Not Forget the Bigger Picture

We're not just talking about cost-saving here; we're also discussing how MFDs are making finance inclusive.

- 3-4 lakh jobs are supported by the MFD ecosystem, from individual IFAs to platform partners

- MFDs are active in metros, towns, and even rural areas, where no fintech or AMC reaches

- You're not just distributing funds, you're educating, handholding, and guiding entire families

Still, commissions are often questioned. While insurance and broking firms earn much higher commissions, MFDs are always under the spotlight. Is that fair?

What MFDs Need to Start Doing Differently

If you're reading this and you're an MFD, it's time to change the narrative.

You've always done your job. Now, it's time to talk about the value you deliver.

Highlight Your Cost-Effectiveness

- ?12,180 crores earned on ?31.42 lakh crore AUM, that's just 0.39%

- You offer real value at the lowest cost

- RIAs charge 1.5x to 3x more, and many don't even handle execution

Show That You Create Employment

- 3-4 lakh people make a living from this industry

- That's more than many AMCs and brokers combined

- You support families, offices, careers - not just AUM

Showcase Your Human Touch

- You answer calls at 9 PM when markets fall

- You explain SIPs to first-time investors

- You're the reason people invest beyond FDs and LICs

No app, no robo-advisor, no platform does that.

Invest in Tech That Speaks For You

Let your back office software tell your story:

- Custom reports, white-labeled with your name

- Timely updates on SIPs, NAVs, and goals

- Clean dashboards that show investors how far they've come

When your work looks professional, people start seeing your value.

Last Words

You are already India's most cost-effective intermediary. So if you combine your personal expertise with modern technology, you can serve more, you can grow faster, and you can earn better, all while still remaining the most affordable advisor for the Indian investor.