India has 853.8 million active WhatsApp users. Every business sector is already using WhatsApp to communicate faster, build trust, and increase conversions.

So here’s the big question: If every other industry can use WhatsApp to grow, why shouldn’t MFDs do it too?

Well, now, with WhatsApp Business API integrated directly into your mutual fund software, you finally can.

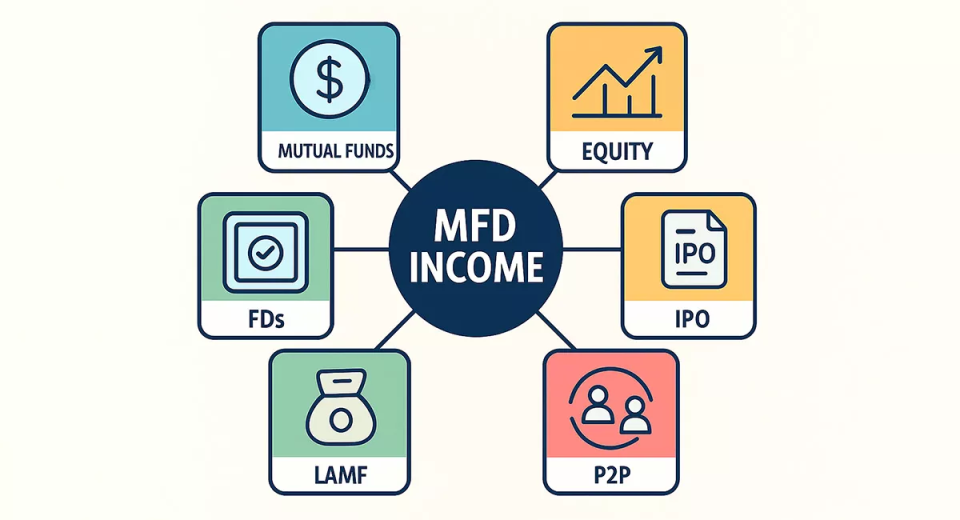

Why WhatsApp Marketing is Revolutionary for MFDs?

Investors trust what they see clearly. They respond to what looks professional.

They engage when communication is convenient.

WhatsApp checks all three boxes — and that’s why your presence here matters. With a Verified WhatsApp Business account, you get:

● Your official business name

● Your logo

● Your website and address

● Your verified green tick badge

This instantly removes doubts and builds immediate credibility. When investors receive messages from your verified profile, they know it’s authentic — not spam, not promotional noise, not “unknown number” messaging.

What You Can Do With WhatsApp Business API?

This is not regular WhatsApp. This is not WhatsApp Web. This is not a broadcast list.

This is enterprise-level messaging built for financial communication.

And because it connects directly with mutual fund software for IFA, you can automate, schedule, and track messages effortlessly. Here’s what becomes possible:

Send Bulk Messages in One Click

Send updates to hundreds or thousands of investors instantly, including:

● NAV alerts

● Market updates

● Fund performance summaries

● Birthday & anniversary greetings

● SIP reminders

● Transaction confirmations

All sent from your verified business identity, not a personal number.

Automate All Investor Notifications

You can fully automate investor communication, such as:

● SIP due reminders

● Missed SIP alerts

● New fund launch updates

● Portfolio reports

● OTP-based verifications

● CAS reminders

● Goal tracking prompts

No manual effort, no follow-ups, no delayed messaging.

Share Portfolio Reports Directly

Because WhatsApp connects with your software, you can share:

● Live portfolio reports

● AUM updates

● P&L reports

● XIRR summaries

● Monthly statements

Deliver reports instantly in formats investors actually check.

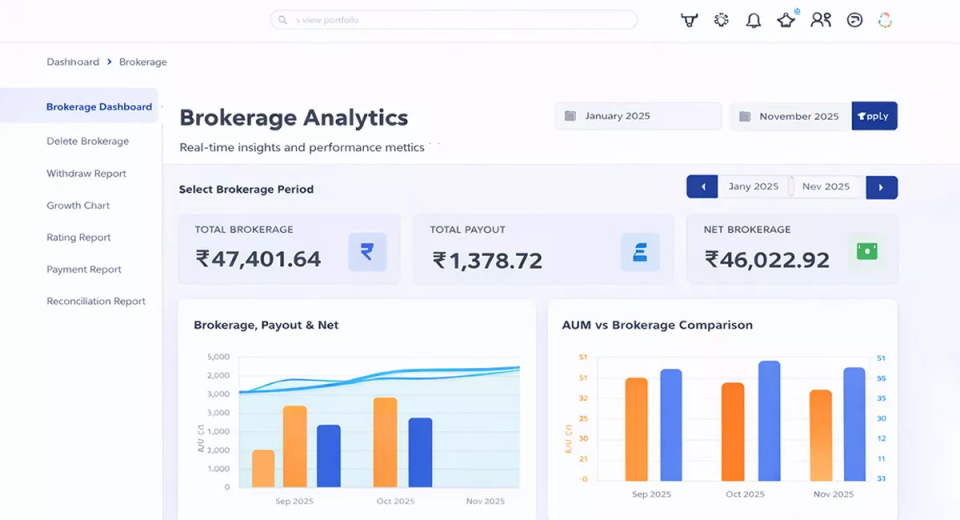

Manage Everything From Your Back-Office Software

You don’t need a separate platform or tool. WhatsApp messaging can be controlled directly from within your software dashboard. Everything is in one ecosystem — simple, integrated, and efficient. All you need to do is just set your message template and get it approved.

Pricing Transparency: You Pay Only for Delivered Messages

One of the biggest concerns MFDs have is cost. Here’s the clarity you need:

● This is a paid WhatsApp feature, where you buy the annual subscription charges.

● Messaging charges are paid directly to WhatsApp

● You are charged only for delivered messages, not for attempted or failed messages

● There is no hidden fee inside the wealth management software

● You pay as per WhatsApp’s official business pricing

This ensures 100% transparency and predictable costs.

Why WhatsApp is More Cost-Effective & Reachable Than SMS?

SMS is becoming less reliable every year — DND restrictions, promotional filters, blocked links, unread messages, and very low engagement.

WhatsApp solves all of this instantly.

Here’s why it’s a smarter option for you:

Higher Read Rate

WhatsApp messages have an average open rate of 98%, while SMS barely touches 20–30%. Your updates actually get seen.

Message Delivery Transparency

SMS often fails silently. WhatsApp shows delivered, read, and failed statuses — so you know exactly what reached your investor.

Rich, Interactive Messaging

SMS can only send text. WhatsApp lets you share:

● PDFs

● Portfolio reports

● Images

● Alerts

● Buttons & quick replies

This makes investor communication more engaging and professional.

More Cost-Effective in the Long Run

SMS charges apply for every attempt — even failed ones.

With WhatsApp, you pay only for delivered messages, which means zero wastage and better cost control.

Preferred by Investors

Investors check WhatsApp multiple times a day. SMS? Rarely. So your important updates reach them faster and more reliably.

Why This Matters for Investor Trust

Your investors are already receiving spam messages daily — unknown numbers, fake fund alerts, random stock tips. If they ignore those, why would they trust your messages if they look similar?

A verified WhatsApp Business account helps you stand out by showing:

● Official branding

● Verified identity

● Secure communication

● Professional execution

● Consistent and timely updates

This is how trust is built — message by message, update by update.

How Does The WhatsApp Marketing Setup Work?

Setting up WhatsApp Marketing through your software is quick and straightforward. Here’s the exact process you follow:

1) Create Your Business Profile

Add your business name, logo, category, website, and address — this becomes your official WhatsApp identity.

2) Submit Your Message Templates For Approval

Every bulk or automated message needs to be approved by WhatsApp (for compliance and investor safety).

Approval usually takes a few minutes to a few hours.

3) Upload Or Sync Your Investor List

Your software automatically syncs investor data, so you don’t manually upload contacts.

4) Start Bulk Messaging In One Click

This is where most MFDs see the real difference:

● Normal WhatsApp account lets you send only 256 messages at a time

● WhatsApp Business API lets you send thousands of messages instantly

All delivered from your verified business identity, not a personal number.

5) Automate Notifications

Once activated, your MF software can automatically send: SIP reminders, portfolio updates, CAS alerts, greetings, OTP flows, and more.

6) Track Delivery & Engagement

See which messages were delivered, read, or failed — directly inside your mutual fund software dashboard.

Final Thoughts

WhatsApp is no longer a casual messaging app. It is now a powerful business communication tool — and MFDs who adopt it early gain a massive advantage.

With WhatsApp Business API integrated into your software, you can automate communication, enhance client experience, and establish stronger investor trust — all from one place.

If modern investors are moving towards convenience, your communication should too. Your next level of investor engagement starts with a verified WhatsApp presence.