Hey MFDs, you must've seen the headlines - SEBI has reduced the exit load cap to 3% and has revised the incentive structure for distributors.

At first glance, many MFDs are wondering, "Does this mean my income will reduce?" Well... not if you play smart.

This move isn't against distributors - it's about encouraging new investor participation, especially from women and smaller cities (B-30 locations). The idea is simple: help more new investors enter the mutual fund world, and you'll still have great earning potential.

But here's the thing - growing your investor base and maintaining consistent inflows takes time, effort, and efficiency.

And that's exactly where technology - especially the best mutual fund software in India - becomes your biggest ally.

Let's break this down.

What SEBI's New Rule Really Means for You

Earlier, a lot of your incentive income came through overall inflows or retention-based bonuses.

Now, the revised structure rewards inflows from new investors (new PANs) - particularly those from B-30 cities and women investors.

Incentives are capped at 1% of the first investment or SIP, up to ?2,000.

So, the focus shifts from just managing existing clients to bringing new ones on board - and ensuring they stay invested.

That means - the more you expand, the better you earn.

But expansion isn't easy if you're still juggling spreadsheets, WhatsApp messages, and separate logins for every asset.

You need one system that helps you reach, onboard, and retain investors effortlessly.

That's Where Back Office Software Makes a Difference

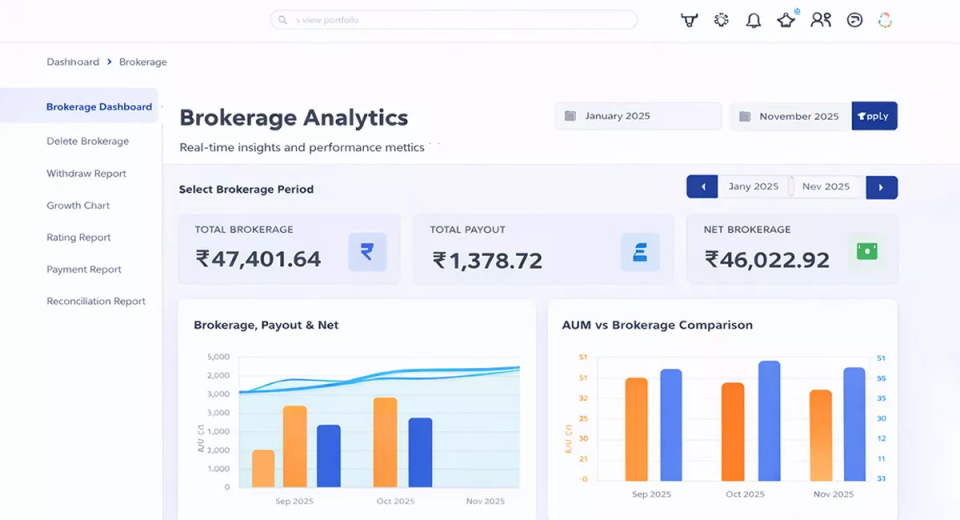

The software for Financial Advisors in India isn't just about showing AUM or portfolio value anymore.

It's your income engine - a digital partner that helps you:

- 1. Diversify your income with multiple asset classes

- 2. Reduce redemptions with smart, goal-based engagement

- 3. Expand your reach through online onboarding and automation

- 4. Offer everything in one place - creating stickier client relationships

Let's look at each one.

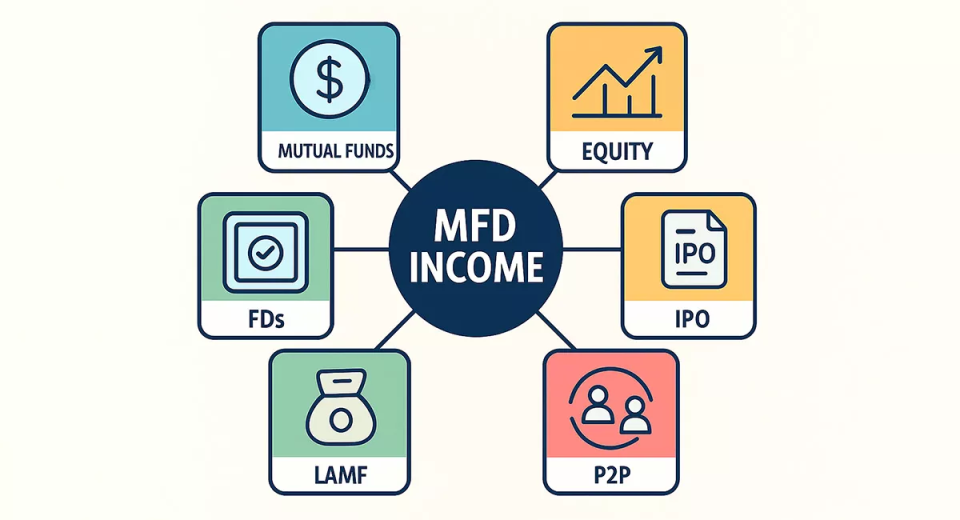

1. Earn More with Multiple Assets

Gone are the days when investors came only for mutual funds.

Today's clients want everything - equity, fixed deposits, loans against mutual funds (LAMF), IPOs, and even P2P lending.

So why let them go elsewhere?

When your platform lets you offer all these under one roof, you don't just retain clients - you also open multiple income channels for yourself.

- Equity: For clients seeking long-term growth

- Fixed Deposits: For those who prefer safety and stability

- LAMF:For investors needing short-term liquidity without redeeming MFs

- P2P Lending: For clients exploring alternate returns

- IPO Investments: For those excited about new opportunities

With every product you add, your income sources multiply, and so does your client's trust in you.

Because at the end of the day, the more needs you fulfill, the less reason they have to go elsewhere.

2. Reduce Redemptions with Goal-Based Planning

Let's be honest - redemptions hurt. You work hard to build that AUM, and one random redemption can wipe away months of effort.

But most investors redeem not because they need money - it's because they lose sight of their goals.

That's where goal-based planning tools inside modern back office software make a huge difference.

Imagine showing your client that their "SIP for child's education" is now 65% complete, or that their "retirement goal" is on track. Would they still redeem? Probably not.

When investments are linked to emotions and goals, clients stay invested longer. And the longer they stay - the higher your trail income grows.

3. Keep Clients Engaged with Everything in One Place

One of the biggest reasons clients drift away is inconvenience.

They use one app for equity, another for SIPs, and yet another for FDs. Somewhere along the line - they forget you.

But when you offer everything on one digital platform, clients stay connected - not just to the investments, but to you as their advisor.

With a good wealth management software, your investors can:

- View all their assets in one place

- Invest, redeem, or switch easily

- Access portfolio reports anytime

- Even get reminders for SIPs or renewals automatically

This convenience builds trust and habit - and that keeps them with you for the long run.

4. Scale Without Losing Personal Touch

As SEBI's reforms push for more inclusion - especially women and B-30 investors - reaching new clients becomes key.

But reaching new investors doesn't mean you have to spend all day chasing leads. With software-driven tools like:

- Automated lead management

- Digital onboarding & video KYC

- Goal tracking dashboards

- Marketing tools

...you can onboard new investors quickly, nurture them digitally, and focus more on relationships than paperwork.

You can be in Jaipur and serve clients in Pune or Patna - without ever meeting them in person.

The Bottom Line

SEBI's new rules aren't meant to limit your earnings - they're meant to push the industry toward more inclusion and investor protection.

And that's good news for MFDs who are ready to adapt. Because those who embrace technology will find more ways to grow, not fewer.

So, if you're still relying on manual tracking, multiple logins, and fragmented tools - this is your wake-up call.