The mutual fund industry in India is changing fast – and guess what? Non-bank Mutual Fund Distributors are now growing faster than banks. If you are an MFD, this is your moment!

A recent AMFI data analysis by Cafemutual shows that MFDs are not just keeping pace with banks – they are beating them in both AUM growth and commission income. And a big reason for this success? Mutual Fund Software for distributors in India. Let's break it down in a simple way.

The Data Speaks – MFDs Are Winning

Here’s what the numbers tell us:

- AUM Growth: Non-bank MFDs grew their AUM from ?6.47 lakh crore in FY21 to ?17.73 lakh crore in FY25 – a massive 174% growth.

- Banks’ Growth: Banks grew from ?3.73 lakh crore to ?7.62 lakh crore – just 104% growth.

- Market Share Shift: Banks’ market share dropped from 37% to 30%, while non-bank MFDs’ share jumped to 70%.

This is a big deal. It means 70% of the regular plan mutual fund business is now handled by non-bank MFDs.

The Commission Story – More Earnings for MFDs

Growth is not just about AUM. It’s also about what you earn.

- Commission Income Surge: Banks grew their commission income by 149%, but MFDs grew by 245%.

- Share of Commission: Banks’ share dropped from 31.6% to 25%, while MFDs’ share went up from 68.4% to 75%.

This means more revenue is now flowing to independent distributors like you.

The Growth Engine – Wealth Management Software for Distributors

So, how are MFDs achieving this level of growth? The answer is simple – technology.

1. Automation Makes You Scalable

Manual work is a growth killer. The top mutual fund software for IFA in India takes away the boring and time-consuming tasks like:

- Digital onboarding & e-KYC

- Automated transactions & SIP execution

- Portfolio reporting (PDF, Excel, or print)

- Compliance tracking and alerts

This means you can handle more clients with the same team, and your business can grow faster without adding big costs.

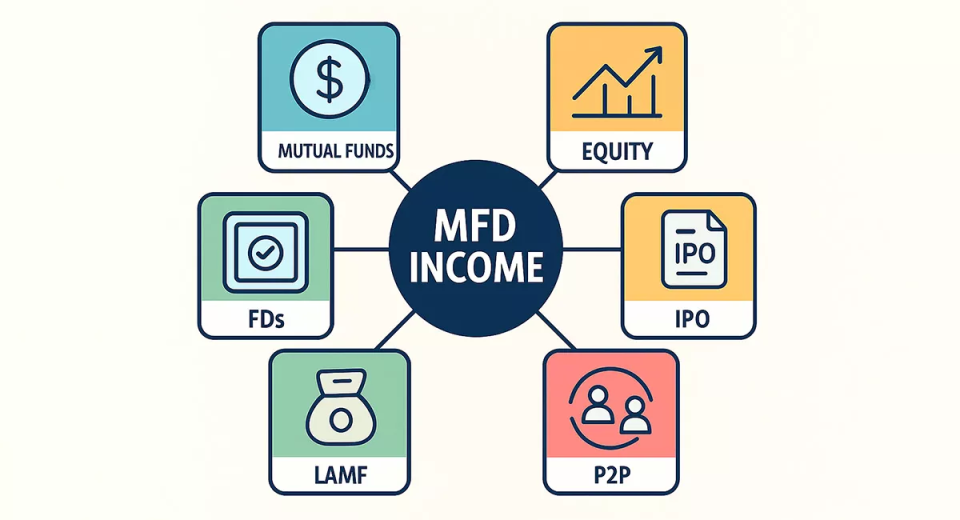

2. Offer More Than Just Mutual Funds

Your clients don’t just want mutual funds. They want a complete wealth solution. Modern software lets you offer multiple asset classes under one roof:

- Mutual Funds

- Equities & Initial Public Offerings

- Fixed Deposits

- P2P Lending

This makes you a one-stop financial solution provider – which means clients stay with you for all their needs.

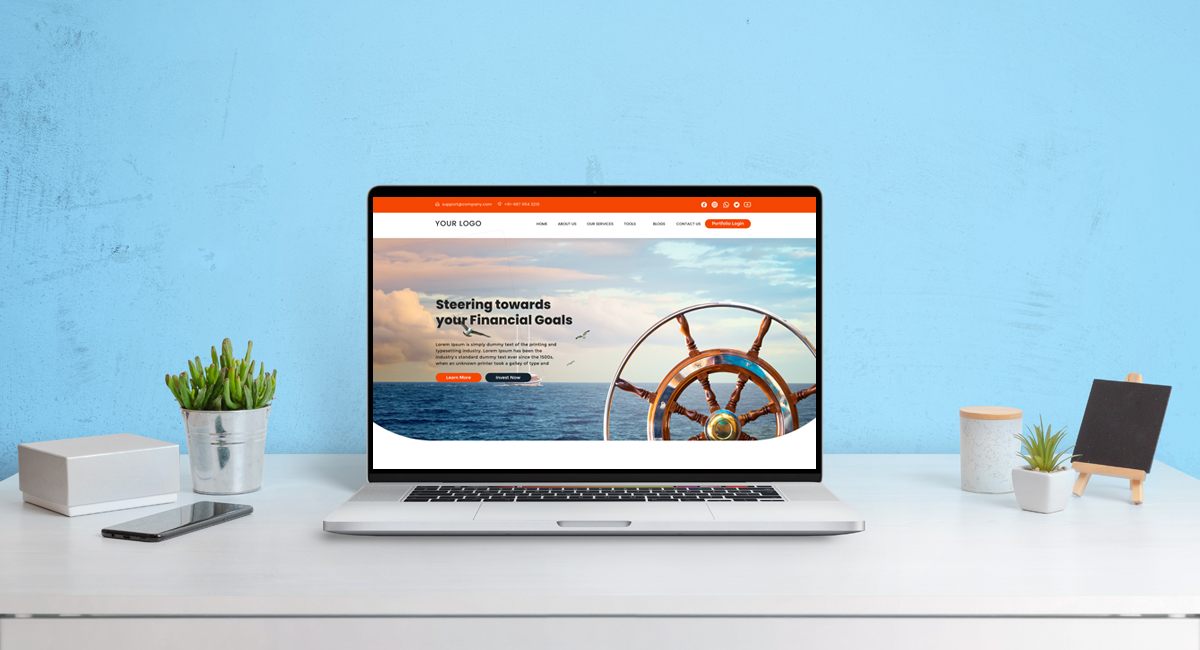

3. Build Your Own Brand (White-Labeling)

Want to look as professional as a bank? With white-labeled software, you get:

- Your logo & brand name on client apps

- Your own branded portal

- Seamless digital experience under your name

This builds trust and credibility with clients for mutual fund distributors.

4. Personalized & Goal-Based Planning

Unlike banks that use a one-size-fits-all approach, you can:

- Create personalized financial plans

- Set client-specific goals (education, marriage, retirement)

- Show real-time goal tracking

This builds deeper relationships and keeps clients engaged.

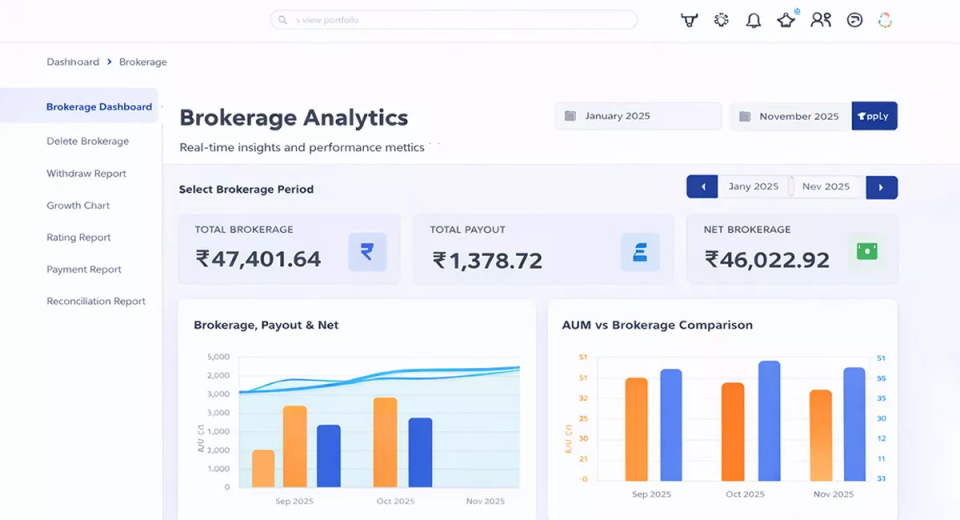

5. Data-Driven Support

Portfolio management software gives you a dashboard to:

- Monitor all client portfolios at one place

- Track performance instantly

- Identify rebalancing opportunities

- Share timely advice with clients

- Use research tools and calculators for accuracy

This helps you build trust and loyalty, which means higher client retention.

6. Risk Profiling & Compliance Made Easy

Staying compliant is crucial. Software helps by:

- Risk-profiling every client automatically

- Highlighting unsuitable investments

- Sending non-compliance reports so you stay on the right side of SEBI

This gives you peace of mind and keeps your business safe.

7. Grow Your Digital Presence

Having a great backend is good, but you also need visibility. Many back office software providers now offer digital marketing panel support like:

- Social media creatives

- Monthly market updates

- festival wishing posts

- Investor education statics

This helps you customize images to branding, which helps in attracting new clients and engaging existing ones.

Why MFDs Can Beat Banks

Banks are big, but they are slow. As an MFD:

- You are more flexible

- You can adopt technology faster

- You can give personal attention that banks can’t

- You can scale your business with software without huge investment

This is why MFDs are winning the game.

Final Thoughts

The future belongs to tech-enabled MFDs, and the numbers are clear: non-bank MFDs are capturing market share, earning more commissions, and building stronger client relationships than banks.

And the secret weapon? MF Software. It automates your work, expands your offerings, strengthens your brand, and keeps you compliant – all while giving clients a better experience.

If you are still running your business manually or with outdated tools, now is the time to upgrade. The MFDs who adopt technology today will be the ones leading the market tomorrow.