“Another SEBI update? Another rule change? What does it mean for me?” We know that’s what you’re thinking, MFDs. And you’re right.

On 8th August 2025, the Securities and Exchange Board of India released a circular removing transaction charges for mutual fund distributors.

Let’s understand this in the simplest way possible. Earlier, you earned:

- ₹100 for every investment above ₹10,000 (existing investor)

- ₹150 for every new investor

Now, that’s gone.

You will not get that small but steady upfront incentive anymore.

So how do you deal with this? And what’s the smarter way to keep your earnings growing? That’s exactly what we’ll cover here.

What This SEBI Change Really Means for MFDs

Let’s break it down simply:

- Less upfront money → Your “quick bonus” per SIP/Lump sum is no longer there.

- More reliance on trail commissions → The only way forward is to build long-term client relationships.

- Focus on quality clients → Not every client adds equal value. You’ll now need to track who contributes most to your AUM.

- Professionalism matters more than ever → With small incentives gone, distributors who work smartly with data and service will stay ahead.

So yes, on the surface, this may feel like a loss. But it’s actually a push towards long-term growth and professionalization for MFDs.

The Hidden Risk: Losing Track of Income Without Proper Tools

Imagine this scenario:

- You no longer have transaction charges to fall back on.

- Your earnings come only from trail commission.

- You’re serving 100+ clients, each with multiple SIPs, lump sums, and redemptions.

Now ask yourself:

- Do you know exactly how much brokerage you’re earning this month?

- Do you know which clients are adding to your trail and which ones are not?

- Can you easily explain your earnings if SEBI/Asset Management Company asks you for clarity?

Without proper tracking, this change can feel like chaos. And that’s where mutual fund software for distributors becomes your safety net.

How Back Office Software Solves the Problem

Let’s get into the real value.

Here’s how software makes your life easier post-SEBI’s new rule:

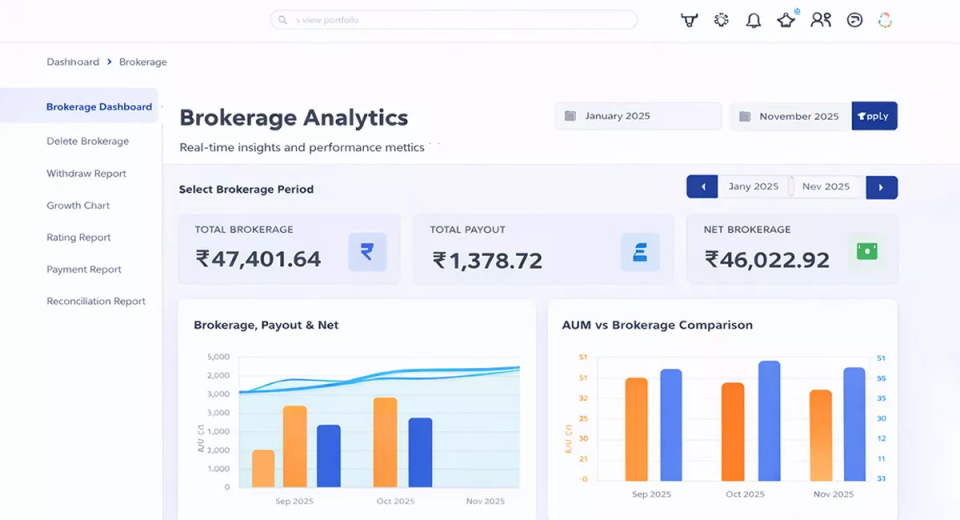

1. Crystal Clear Brokerage Tracking

- No transaction charges = all focus on trail

- The software shows exact brokerage earned, client-wise and scheme-wise

- No confusion, no guesswork

2. Investor-Wise Income Reports

- Identify your top clients who contribute more to your AUM

- Focus your energy on clients who matter most

- Spot inactive or low-value clients easily

3. SEBI-Ready Compliance

- Every report you need for compliance is generated automatically

- Be audit-ready anytime

- Zero stress on manual reconciliation

4. Automation That Saves Time

- Auto-reminders to clients for SIP dates, renewals, or redemptions

- Auto-portfolio updates for better communication

- You stay in touch without chasing people individually

In short, software replaces uncertainty with clarity.

Why This Change is Actually an Opportunity

Think of it this way, earlier, you had small short-term gains (transaction charges). Now, you have the chance to build big long-term gains (trail + strong client base).

This SEBI change pushes you to:

- Be more professional

- Focus on relationships, not one-time transactions

- Use technology to run your business like a real financial entrepreneur

And if you’re using the right mutual fund software for IFA, this transition is not a headache. It’s a chance to grow smarter and faster.

A Simple Example to Understand

Let’s say you onboarded a new investor earlier. You’d earn:

- 150 upfront transaction charge

- Plus trail (small at first, bigger later)

Now, you only earn the trail. But here’s the magic:

- With software, you track every investment that the client makes

- You keep them engaged with reports, reminders, and updates

- That one client invests regularly for 10+ years

If a client continues investing for 10+ years, the long-term trail income + referrals can far outweigh a one-time ₹150.

The Mindset Shift Every MFD Needs

Instead of thinking: “I lost ₹100-150 per transaction”

Start thinking: “I’m building ₹ lakhs of future trail, and my software is my partner in keeping track of it.” This is how top distributors think.

Conclusion

Yes, the Securities and Exchange Board of India has removed transaction charges. But no, it’s not the end of the world for you. In fact, it’s the beginning of a more professional, transparent, and long-term business for you.

With the right software, you’ll track your income without stress, stay SEBI-compliant, build deeper investor relationships, and focus on trail income, the real engine of your MFD business earnings.

So, instead of worrying about what’s lost, let’s focus on what’s gained. Because in this new era, smart MFDs with smart software will always thrive.