Today’s investors expect one thing above everything else: convenience. They want simple steps, instant access, and a platform that doesn’t feel complicated. If their investing journey is confusing, they either drop off or contact you repeatedly for support.

This is why website-based investing has grown rapidly. It feels smooth and intuitive because clients already spend most of their online time browsing websites. But this shift also raises an important question:

Is website investing really easier than using mutual fund software? The answer is yes — but only when both systems work together.

Website investing is not a replacement for software. It is a simpler, more user-friendly layer for clients, powered entirely by your MF software in the background. And this is where website-based investing through Web Robo becomes essential.

What Exactly Is Website-Based Investing?

Website investing happens directly on your own domain, not on an external platform. To understand website investing, it’s important to define Web Robo clearly — because it powers the entire journey.

Web Robo is an investor-facing onboarding and transaction tool that connects your website directly with the best mutual fund software in India. By now, you know that you either need to have an existing website or make a new one.

Web Robo enables your clients to:

● Complete eKYC

● Set up eMandates

● Create their risk profile

● Define financial goals

● Explore popular fund categories

● Invest online directly through your website

● Follow a structured, simple investment journey

— all without ever actually interacting with the software interface.

In simple terms:

● Your Website → The front-end clients use

● Web Robo → The engine that handles onboarding and transactions

● Back Office Software → The backend where data is stored, synced, and managed

Together, these three components create a complete, automated, and seamless digital investing ecosystem.

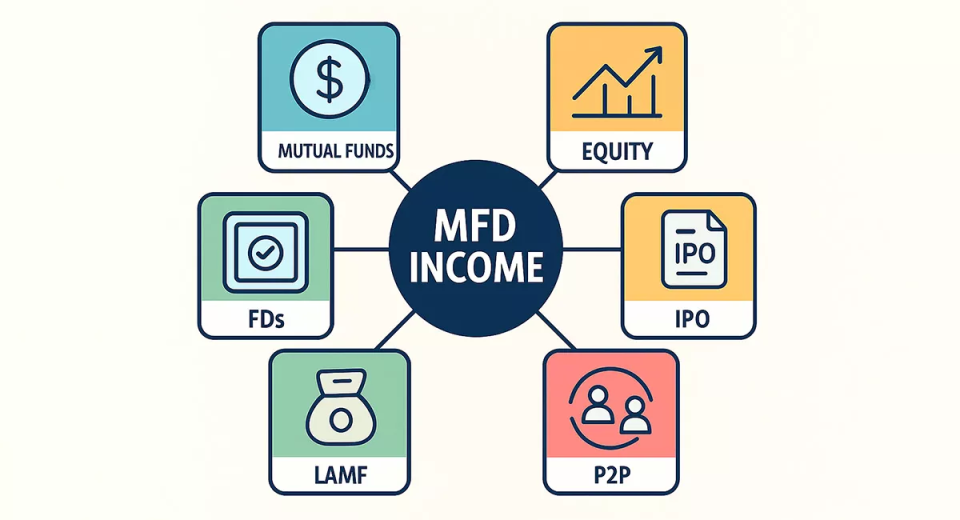

Why Web Robo Matters for MFDs?

Web Robo does more than simplify the investor journey — it strengthens your business operations.

● It carries your branding

● Requires no technical setup

● Reduces manual tasks and operational load

● Automatically syncs all data to your back office

● Ensures all mandatory disclosures are displayed

● Helps you deliver a modern, digital-first client experience

In short, Web Robo transforms your website into a functional, end-to-end investing platform.

Why Website Investing Is Becoming the First Choice for Clients?

Clients are already comfortable completing tasks online — shopping, bill payments, registrations, and more. Naturally, they expect the same simplicity when investing.

What Clients Prefer About Website-Based Investing

● No complicated login process

● No app installation

● No overwhelming dashboards

● No constant handholding required

● A straightforward, mobile-friendly journey

They simply visit your website, follow a guided flow, and complete their investment.

This ease is possible only because Web Robo handles all the complexity in the background.

A Common Misconception: A Website Alone Cannot Enable Investing

Many MFDs assume that adding an “Invest Now” button is enough to offer online investments.

It isn’t. A website cannot manage:

● Investor onboarding

● KYC verification

● Mandate processing

● Fund data

● Regulatory checks

● Risk profiling

● Goal planning

● Transaction routing

● Audit trails

● Back-office updates

This is why your website needs Web Robo — and why Web Robo needs your wealth management software.

A complete online investing setup requires three connected components:

1. Your Website – where clients begin

2. Web Robo – the engine managing onboarding and transactions

3. Mutual Fund Software – the system for records, compliance, and reporting

Only when all three work together can you deliver a smooth and compliant digital investing experience.

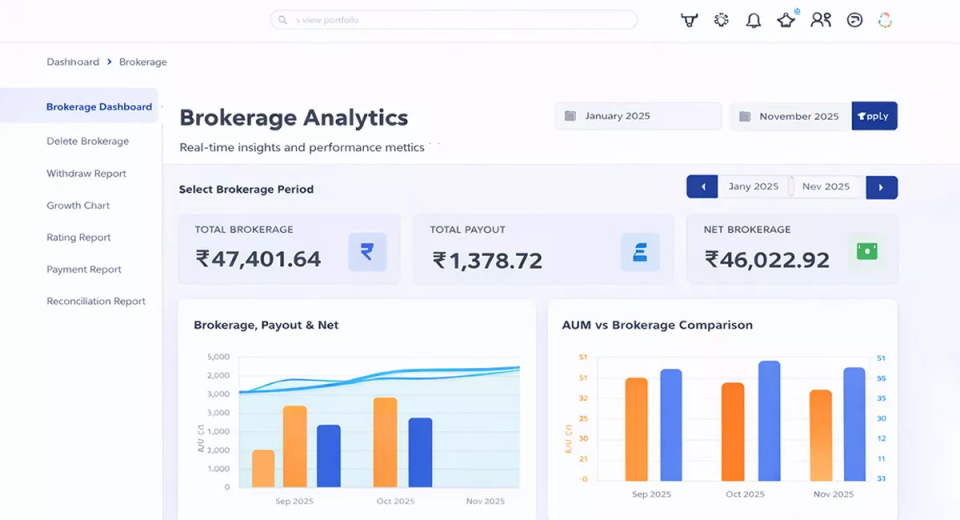

Where MF Software Fits In — The Backbone of Your Business

No matter how advanced the client journey becomes, your software remains central to your operations. It manages:

● Client data

● Folio details

● Portfolio reports

● Brokerage and commissions

● AUM tracking

● Transaction records

● Audit trails

● Regulatory compliance

● Core back-office workflows

Website investing does not replace your software.

It enhances it by giving clients a simpler interface while the software handles everything behind the scenes.

Why Website Investing Feels Easier — The Web Robo Advantage

To clients, Web Robo makes the journey look effortless.

What Clients See

● Risk Profiling

● Fund selection

● Enter details

● Complete eKYC

● Set up eMandate

● Invest instantly

What Web Robo Handles Internally

● Scheme-level data

● Category-wise fund listing

● Performance charts

● Exit load details

● Riskometer

● Suitability checks

● Data validation

● Order processing

● Automatic syncing with your software

Clients see only the simplicity — not the complexity.

How MFDs Benefit From This Integrated System

1. Lower Operational Burden

Reduces manual entries, form checks, and repeated KYC follow-ups.

2. 24/7 Digital Onboarding and Investing

Clients transact anytime — without waiting for your support.

3. Automatic Back-Office Syncing

All mandates, transactions, and details flow directly into your software.

4. Higher Completion and Conversion Rates

A smoother journey means more clients complete the process.

5. A Strong Digital Presence

Your website becomes a productive business tool, not just an information page.

6. Easy Compliance

Web Robo ensures all required disclosures appear automatically.

So, Is Website Investing Better Than Mutual Fund Software?

The honest answer:

For Clients:

Website investing feels easier because it offers a simple, intuitive, mobile-friendly experience.

For MFDs:

Software remains indispensable — it powers operations, compliance, reporting, and backend processes.

The Real Solution:

Not one or the other — but BOTH working together.

● Your Website guides and attracts clients

● Web Robo delivers a smooth onboarding and investing experience

● Your Software manages data, compliance, and records

Together, they create a powerful digital ecosystem that helps you scale, serve clients better, and build a future-ready business.

Final Takeaway

If you want to simplify client journeys, reduce workload, and offer a seamless digital investing experience, the answer is not choosing between platforms.

The answer is integration: Your Website + Web Robo + Software

This is the only combination that ensures convenience for clients and accuracy, compliance, and efficiency for your business.

Website investing becomes truly “easy” only when the right software powers it behind the scenes — and that is exactly what Web Robo enables.