MFDs, we get it, your biggest dream is to grow, scale, and serve more investors. But the reality? You spend most of your working hours doing the most basic tasks, like onboarding investors, placing transactions, and following up on forms.

But let's be honest, this wasn't the plan. Think about it:

| Method | Time per Client | Clients/Day | Total Onboarding Time/Day |

|---|---|---|---|

| Manual | 30-60 minutes | 5 | 2.5-5 hours |

That's almost half your working day, gone, just onboarding investors.

And we haven't even counted the time you spend placing transactions or generating reports.

But what if there was a smarter way?

Is There a Way to Run These Tasks on Autopilot?

Yes. And it's already here, because the Robo Advisory Software India is not just a trend, it's a real, working solution that's changing how MFDs do business.

This isn't about replacing you. It's about empowering you.

What is a Robo Platform?

The Robo Advisory platform in India is a self-investment app built under your branding.

It's Do-It-Yourself investing for your clients, and Do-Less-Work for you.

How It Works for Investors

No need for lengthy forms, manual data entry, or back-and-forth calls.

Here's how easy it is for investors:

Step-by-Step Investor Experience:

- Self-Sign-Up via your branded mobile app

- PAN, KYC & Contact Info Auto-Fetched

- Nominee & Bank Details Added with a few taps

- FATCA Declaration? Just a click

From zero to investment-ready in just minutes.

Once onboarded, investors can explore and invest in mutual funds without waiting for your availability.

Let's Compare the Time Spent

| Method | Time per Client | Clients/Day | Total Onboarding Time/Day |

|---|---|---|---|

| Manual | 30 60 minutes | 10 | 5 10 hours |

| App-Based | 5 minutes | 10 | 50 minutes |

That's 90% less time spent onboarding clients.

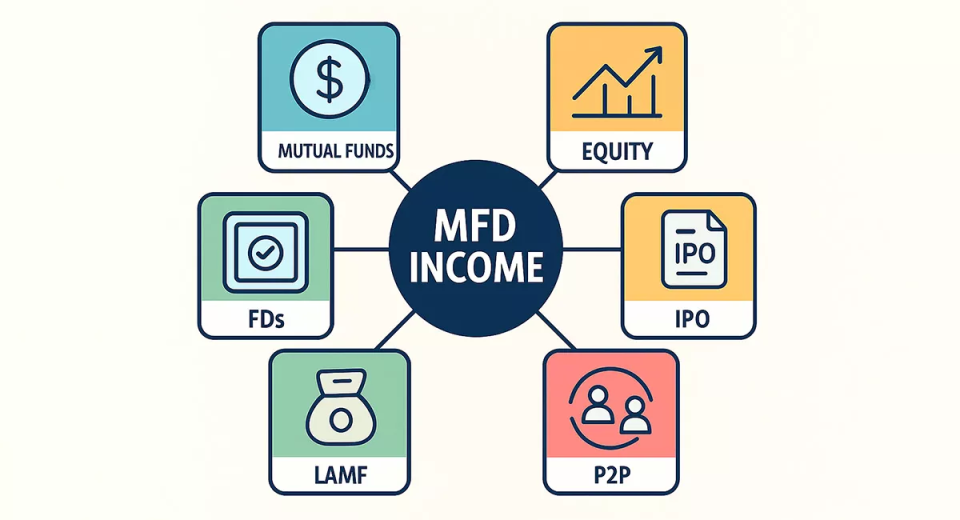

How Does This Gives You an Edge Over Direct Platforms?

Let's talk competition.

Direct mutual fund apps offer:

- Self-onboarding

- DIY transactions

- Instant access

- 24x7 convenience

That's how they scale fast, grow AUM, and focus only on:

- Getting more referrals

- Running marketing campaigns

- Reaching new investors

But now, you can offer the same experience under your own brand.

With your robo advisory technology in India:

- Investors can self-onboard and transact

- You save hours every week

- You stay available when support is needed

- Your branding stays in front of the investor

Your edge?

- The tech convenience of direct apps

- Trust of a personal MFD

You compete smartly. You save time. You scale faster. You stay in the game.

Why is This Revolutionary?

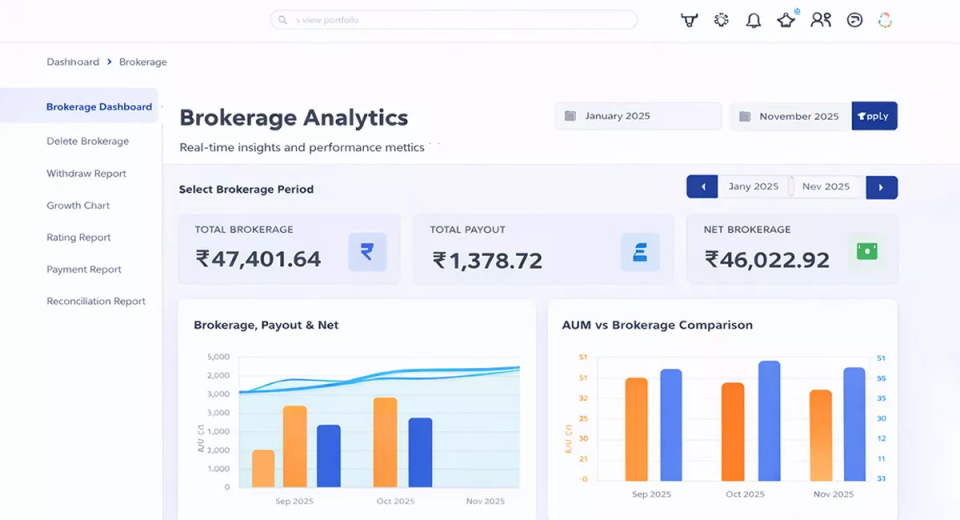

Let's break down the time savings on a larger scale.

If you're onboarding just 10 investors manually every day, that's roughly 5 10 hours spent daily.

In a typical month of 22 working days, you're looking at 110 to 220 hours spent just on onboarding alone. That's almost a full-time job!

Now, if you switch to an app-based system where onboarding takes just 5 minutes per client, you're spending less than 18 hours a month on the same number of clients. That's a massive time saving of 100 to 200 hours per month.

Imagine what you could do with that time:

- Meet more high-value clients

- Host investor awareness sessions

- Upskill yourself and your team

- Strengthen your digital marketing

- Focus on referrals and client retention

Time is your most limited resource. And with automation, you're not just saving time, you're freeing yourself up to think bigger, plan better, and execute faster. These saved hours are your real asset to scale, without burning out.

This isn't just about saving time. It's about transforming the way you work.

Save Hours Every Week

- No more manual KYC

- No more paperwork

- No more chasing clients for details

Run Your Business on Autopilot

- Investors manage everything on their own

- You just monitor and guide when needed

Focus on Scaling

- Use saved hours for business development

- Reach more prospects

- Serve more clients with ease

Brand Visibility Like Never Before

- Your app, your logo, your name

- MFD branding stays intact

- Makes you look tech-forward and modern

Share Your Link, Grow Your Client Base

- Simply share your app link

- New investors can sign up instantly

- No long forms, no friction

Get More Referrals

- Happy clients share your app

- You grow without extra effort

The Shift MFDs Need to Make in 2025

We're in 2025. Everything is digital. Yet many MFDs are still stuck doing things the old way.

If you're spending:

- 3 hours daily on onboarding

- Another 2 hours on placing transactions

- And even more on reports and queries

Technology is here to support you

Then something has to change. Technology isn't here to replace you. It's here to support you. To give you:

- More time

- More freedom

- More scale

Final Thoughts

The question isn't "Should I adopt a robo-advisor?" The real question is: How much more can you grow when your business runs on autopilot?

With robo platforms, you can bring in more investors, offer faster service, and stay relevant in the digital age — all while saving hours every single day.