For years, mutual fund software has been the backbone of every MFD’s business.

It helped you manage transactions, generate reports, automate operations, and serve clients efficiently.

But the industry has changed. Today, having software is not enough. To stay relevant, trustworthy, and discoverable, MFDs must build a digital presence too — and the recent AMFI–SEBI mandate proves how important this has become.

Let’s understand why the shift is happening… and what it means for you.

Why Back Office Software Alone Isn’t Enough Anymore

Your mutual fund software for IFA handles the back office. But where do investors first notice you? Where do they form opinions about your brand? Where do they decide if they can trust you? Online. Across multiple digital touchpoints.

Your presence on:

● Social media

● A professional website

● Investor-facing tools

…now plays a major role in whether an investor wants to work with you or not.

This is why SEBI and AMFI have now stepped in.

AMFI’s New Requirement: Every MFD Must Declare Social Media Details

AMFI has officially directed all mutual fund distributors to submit their social media handles on the AMFI website.

This includes:

● YouTube

● X (Twitter)

● Telegram

● Threads

● Any other official social channel

You must also provide:

● Your website URL

● Your mobile app links (if any)

● Your official email domain details

And here’s the important part: These details will be published on AMFI’s "Locate a Distributor" page for investors to see.

Why? Because AMFI wants investors to easily verify your identity, avoid cyber fraud, and differentiate real MFDs from fake accounts.

This is a big deal — because it officially recognizes that your digital presence is now part of your identity as a distributor.

What This Means for You as an MFD

You’re no longer evaluated only by:

✔ Your ARN

✔ Your software

✔ Your physical office

You are now evaluated by:

⭐ How you appear online

⭐ Whether investors can find correct information about you

⭐ Whether your branding is consistent across platforms

⭐ Whether your communication style builds trust

⭐ Whether your online identity looks credible and professional

This is why digital presence is no longer optional.

It’s a compliance requirement + brand-building opportunity.

Why Digital Presence Matters Today

1. Investors Research You Before They Contact You

Before speaking to you, investors check:

● Your Google profile

● Your Instagram page

● Your LinkedIn activity

● Whether you explain financial concepts online

● Whether you post regularly

● Whether your communication feels trustworthy

If you’re invisible online, you automatically lose credibility.

2. Investors Trust Verified Channels Over Unknown Numbers

With so many scam messages floating around, investors are cautious.

A verified WhatsApp account, a professional website, and active social handles show that:

● You are real

● You are reachable

● You are transparent

● You follow industry norms

This trust translates directly into business.

3. Digital Presence Helps You Educate, Engage & Convert

A software helps with execution. Your digital channels help with:

● Building awareness

● Answering investor questions

● Sharing educational content

● Increasing investor comfort

● Getting more inbound leads

An MFD with strong digital content becomes a trusted educator, not just a distributor.

4. Your Competitors Are Already Doing It

Banks, fintech apps, national distributors, and individual MFDs are all using social media to attract investors. If your presence is missing, investors assume:

● You’re not updated

● You may not be active

● You may not provide digital experience

● You may not match modern expectations

That perception can cost you real business.

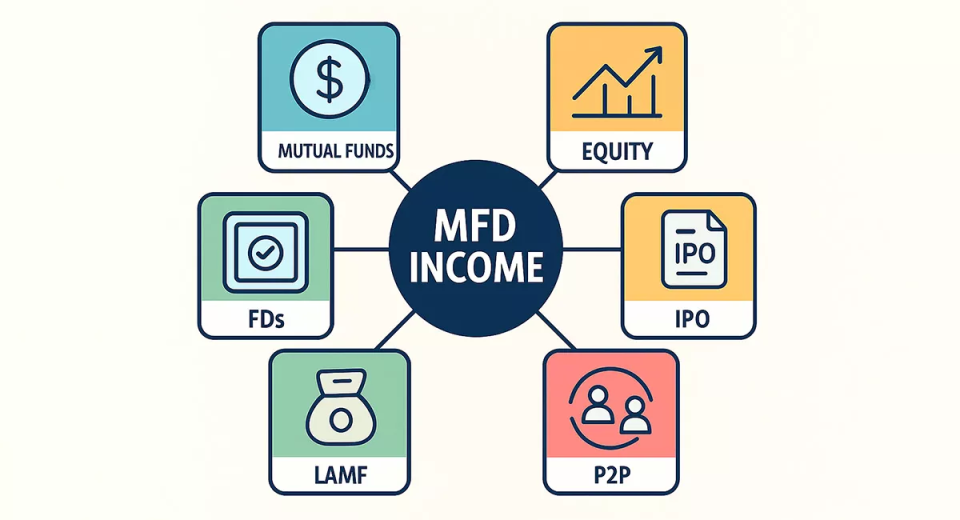

Why MF Software + Digital Presence = The Winning Combo

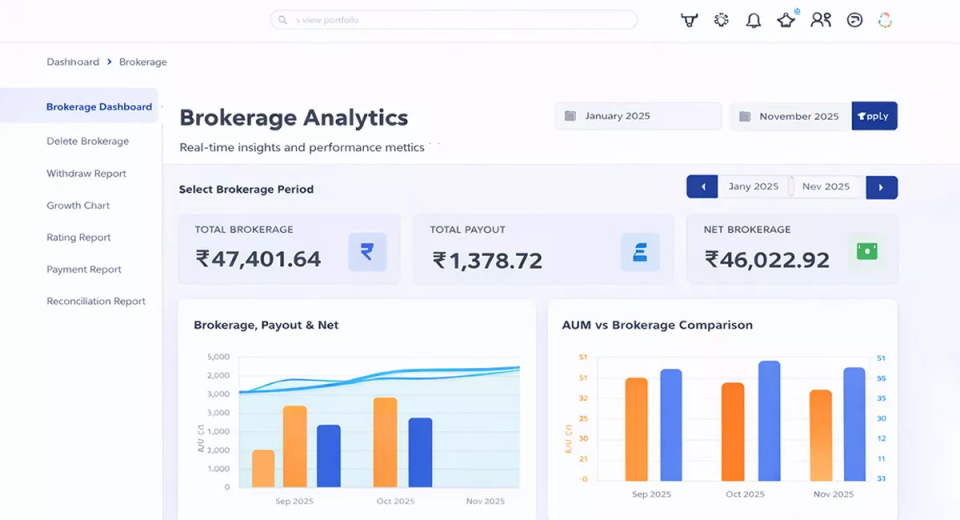

Wealth Management software manages:

● Operations

● Transactions

● Reporting

● Analytics

● Automation

Digital presence manages:

● Branding

● Awareness

● Trust

● Communication

● Lead generation

One supports your back-end. The other supports your growth engine. In 2025 and beyond, you need both. Because investors want a distributor who is:

✔ Technically capable

✔ Digitally accessible

✔ Socially visible

✔ Professionally active

Software helps you run your business. Digital presence helps you grow it.

What You Should Start Doing Immediately

Here’s what every MFD needs to do now:

1. Create or update your social media handles

Make sure you have at least:

● YouTube (even if you upload simple videos)

● WhatsApp Business

These will now be listed publicly on AMFI’s website.

2. Build a simple, professional website

Even a two-page website builds massive credibility.

3. Use WhatsApp for investor communication

Verified WhatsApp is becoming mandatory for trust.

4. Share financial content regularly

Consistency builds brand memory.

5. Ensure your digital identity matches your office identity

Same logo, same colors, same tone = strong brand recognition.

Final Thoughts

You invested in MF software to operate efficiently. But today, that’s only half the journey. Your future growth depends on: How visible, trustworthy, and accessible you look online. With AMFI now making digital presence a formal requirement, the message is clear: A strong digital presence is no longer optional. It’s a core part of being a modern MFD.

Your investors are online. Your competition is online. Your identity is online. It's time your business grows there too.