Over the past few years, something very interesting has happened in the Indian mutual fund industry — the number of Mutual Fund Distributors (MFDs) has grown rapidly.

According to Cafemutual's analysis of mutual fund industry data, the number of individual ARN holders in India increased from 1.10 lakh in September 2022 to 1.71 lakh in September 2025. That’s a growth of around 55% in three years, with a CAGR of over 15%.

That’s not a small number. It clearly shows one thing — more people than ever are choosing MFD distribution as a profession and business opportunity.

But why is this happening?

There are many reasons — financial awareness, rising SIP culture, growing equity participation, digital onboarding — and among them, mutual fund software has quietly become one of the biggest growth enablers.

Let’s talk about how.

The Rise of MFDs in India

The industry saw a strong rise in MFDs in both T30 cities and B30 cities. In fact, B30 cities grew even faster, showing how mutual fund distribution is no longer a metro-only activity.

Plus:

● Total ARN holders across India rose from 2.15 lakh to 3.21 lakh

● Corporate employee ARN holders grew significantly

● Young professionals and fintech-aware individuals are entering distribution

So yes — the industry is expanding fast.

So, What’s Driving So Many New MFDs?

There is no single reason — it’s a mix of multiple factors:

● Higher financial awareness

● Growing investor trust in mutual funds

● Strong SIP growth

● Better industry regulation

● Clear income potential

But there is one practical reason that has made the journey simpler, faster, and more scalable — the availability of the best mutual fund software.

Earlier, becoming an MFD meant:

● manual paperwork

● physical signatures

● Excel-based tracking

● offline statements

● separate tools for research, transactions, reports, and client management

Today, most of that is done on one platform.

How Back Office Software is Fueling The Rise of MFDs

Portfolio management software hasn’t just automated processes; it has made the business easier to start, faster to scale, and simpler to manage.

Here’s how it is contributing to growth

1. Starting as an MFD has become easier

Earlier, operational complexity scared many people away.

Now with software:

● Client onboarding is digital

● FATCA/KYC journeys are guided

● Transaction platforms are integrated

● Reports are auto-generated

So someone new in the industry does not feel lost. They have a ready-made system to run their business from day one. This attracts:

● young distributors

● career shifters

● RIAs transitioning to distribution

● fintech-savvy professionals

2. Operations are no longer manpower-heavy

Earlier, growing your MFD business meant:

● hiring more staff

● more paperwork

● more manual data processing

Now one platform can handle:

● SIP/STP/SWP execution

● brokerage tracking

● AUM reports

● capital gain statements

● portfolio reviews

● client communication

So even:

● solo distributors

● small IFA firms

● new ARN holders

can manage large client bases using software — without a big team. This reduces entry barriers significantly.

3. Compliance is easier to manage now

Regulatory compliance is stricter today — but wealth management software has made it much easier to follow. Things that once required manual tracking, such as nominee updates, missing PAN/Aadhaar details, risk profiling, FATCA, audit records, etc, are now simplified with non-compliance reports, pre-built checklists, and auto tracking tools.

This gives confidence to new MFDs who may otherwise worry about regulation and paperwork.

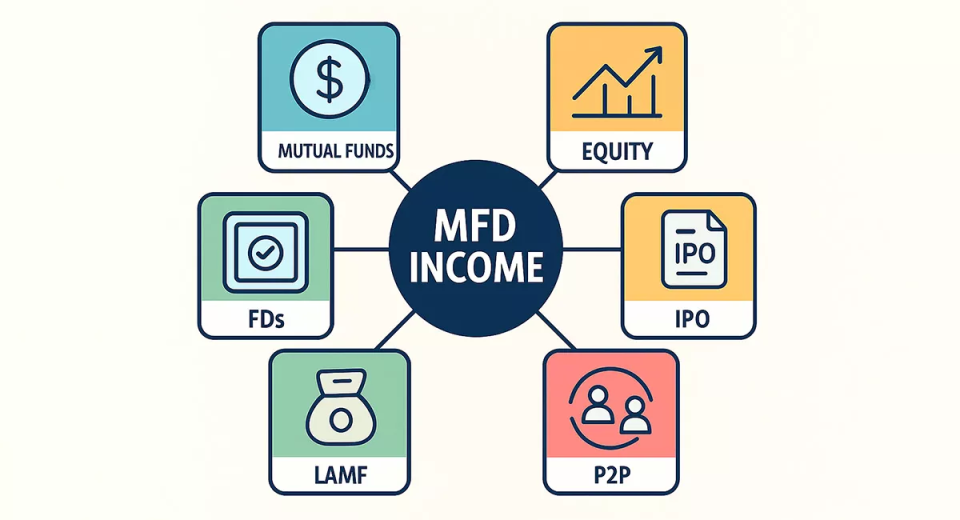

4. Digital investor experience attracts new-age MFDs

Today’s MFDs don’t just want to sell products; they want to build a tech-enabled advisory brand.

MF software now offers:

● investor mobile apps

● online portfolio access

● WhatsApp marketing

● AI chatbots

● online transactions

● client dashboards

This appeals to younger professionals who want to run modern, digital-first MFD practices instead of traditional offline setups.

They see distribution not just as selling mutual funds, but as running tech-powered wealth businesses.

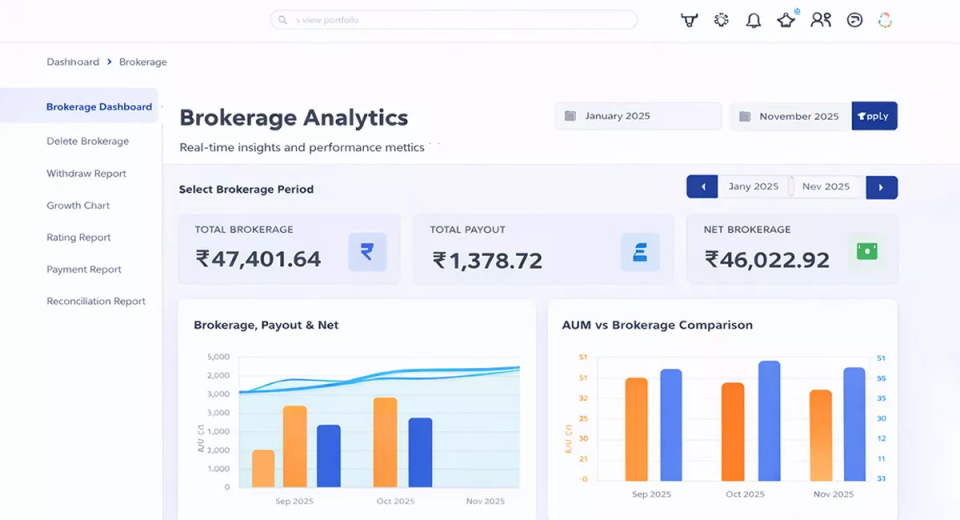

5. Revenue visibility motivates expansion

One big motivator for entering or scaling any business is this: clear visibility of earnings

With brokerage dashboards and income analytics inside the software, MFDs can now:

● Track AUM growth

● Analyze brokerage trends

● See top top-earning clients

● Measure sub-broker contribution

● Forecast income

When you can see your earnings clearly, you feel more confident investing time and effort into the business.

This attracts new entrants and keeps existing MFDs expanding.

So, Is Software The Only Reason for MFD Growth?

No — and it’s important to say that clearly.

Growth has also been driven by:

● deeper financialization in India

● rising SIP adoption

● investor shift from gold/FD to markets

● distributor awareness programs

● regulatory push for transparency

● increasing digital literacy

However… software has acted as an accelerator. It hasn’t created the industry, but it has made entering and scaling far simpler than before.

It has:

● reduced friction

● reduced costs

● reduced effort

● reduced dependency on manual work

And that’s exactly why more people feel confident becoming MFDs today.

Final Thoughts

The rise of MFDs in India is real, and while multiple forces are driving this growth, software has played a major supporting role by simplifying operations, enabling digital onboarding, improving investor experience, reducing manual work, bringing revenue transparency, and making the business scalable.

The industry was already growing. Technology gave it speed. And as software continues to improve, we may see even more new MFDs joining the industry in the coming years.