The mutual fund distribution industry in India is growing at a rapid pace.

As per industry data, between April and December 2025, more than 51,000 new Mutual Fund Distributors (MFDs) were added. This means more competition, more digitally aware investors, and higher expectations from you as a distributor.

If you’re entering the industry in 2026, or if you’re already an MFD but not fully satisfied with your current software, choosing the right mutual fund software is no longer optional. It directly impacts your efficiency, compliance, and investor experience.

Why You Need MF Software in 2026

Running a mutual fund business today is not just about suggesting schemes.

You’re expected to:

● Handle online transactions (SIPs, switches, redemptions)

● Track portfolios across multiple AMCs

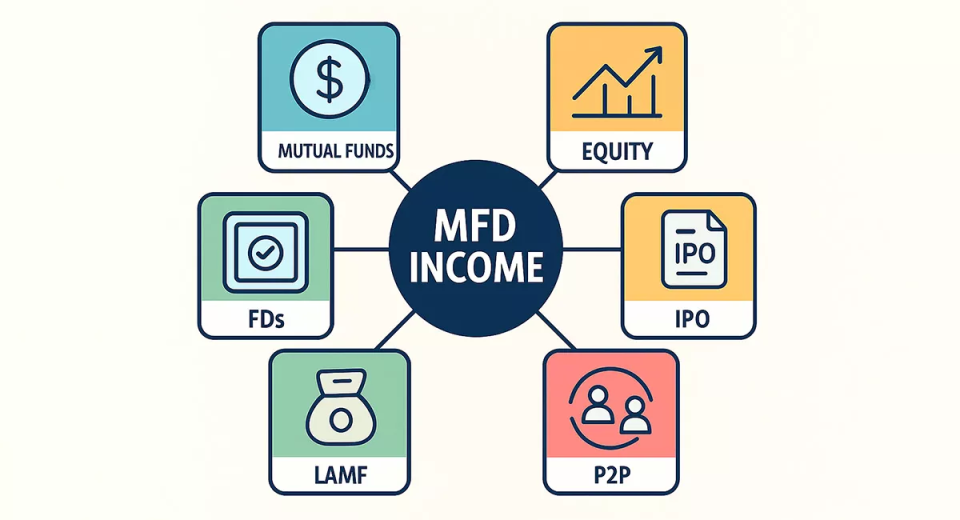

● Offer investors access to different asset classes

● Stay compliant with SEBI and AMFI guidelines

● Generate clear, timely reports

● Respond quickly to investor queries

Managing all this manually increases errors, delays, and stress. The right portfolio management software helps you:

● Automate routine operations

● Reduce compliance risk

● Improve investor communication

● Save time and effort

● Scale your business smoothly

What All Software Platforms Already Offer

Before comparing platforms, it’s important to understand one thing clearly: All the platforms listed below offer the basic, essential features.

That includes:

● ✅ Online transactions (invest, SIP, redeem, switch)

● ✅ Multi-asset support (mutual funds, and in many cases other assets)

● ✅ Portfolio tracking & reports

● ✅ Compliance & KYC support

● ✅ Web and/or mobile access

So the question is not whether a platform offers these basics.

The real difference is in how well they solve your day-to-day problems, through automation, reporting depth, investor experience, and ease of use.

What to Look for While Choosing MF Software

When all platforms offer the basics, your decision should depend on these factors:

1. Ease of Use

If the software is complicated, adoption becomes a problem — for you and your investors.

2. Compliance & Risk Visibility

Non-compliance reports and alerts help you avoid regulatory issues before they become serious.

3. Reporting That Helps You Explain

Tools like Scheme vs Benchmark, underperformance tracking, and clean portfolio reports build investor trust.

4. Automation & Bulk Actions

Bulk SIPs, bulk switches, and bulk redemptions save hours every month.

5. Investor Engagement

Investor apps, chatbots, notifications, and language options improve retention.

6. Scalability

Your software should grow with your client base, AUM, and product mix.

Leading Wealth Management Platforms for MFDs in 2026

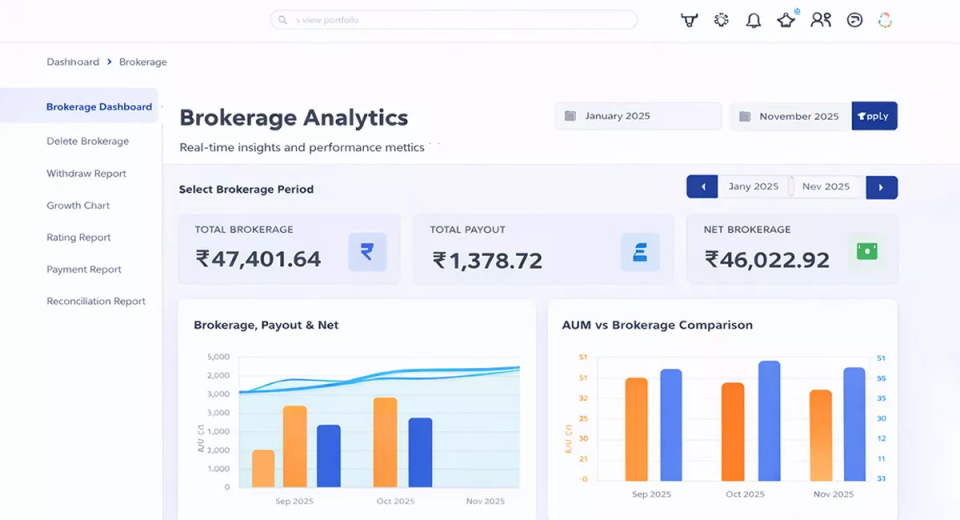

1. REDVision Technologies

REDVision Technologies is one of the best mutual fund software platforms used by MFDs in India.

Key Features

● AI-powered chatbot for instant investor queries

● Scheme vs Benchmark reports to track underperforming schemes

● Investor apps available in 10 Indian languages

● Strong back-office, analytics, and reporting tools

● Automation to reduce manual follow-ups

● Brokerage analytics dashboard

● Portfolio overlap analysis report

● WhatsApp API integration

● Apps, Websites, Web-linked onboarding tools, Marketing services, all under one roof

Why REDVision Works Well

If investor engagement, reporting clarity, and future-ready AI-backed technology are important to you, REDVision helps you manage clients efficiently without increasing workload.

Best suited for:

MFDs who want strong analytics, better investor experience, and scalable technology. If you need not just software, but a whole ecosystem that helps MFDs grow and scale AUM, then REDVision is the platform for you.

2. Wealth Elite

Wealth Elite is another mutual fund software in India known for its execution-focused and operations-driven approach.

Key Features

● Bulk switch and bulk redemption options

● Centralised back-office management

● Faster transaction execution

● Clean dashboards and reporting

● Multi-asset support

● Brokerage module

● Step up SIP, Step up SWP, and other advanced calculators

● OTP Based CAS

Why Wealth Elite Works Well

If manual execution and repetitive operational work are slowing you down, Wealth Elite helps you gain speed and control with AI-backed capabilities and constant after-sales service support.

Best suited for:

MFDs handling higher volumes who want operational efficiency.

3. MutualFundSoftware

MutualFundSoftware is another one of the mutual fund software for distributors, widely used for its strong focus on compliance and governance.

Key Features

● Non-compliance reports

● Audit-ready reporting structure

● Portfolio and transaction tracking

● Heldaway portfolios

● 30+ reports

● Model portfolios, Fund factsheets, & more

Why MutualFundSoftware Works Well

If compliance visibility and risk monitoring are your top priorities, this platform gives you better control and peace of mind.

Best suited for:

MFDs who want structured, compliance-first operations.

4. Investwell Mint

Investwell Mint is a cloud-based platform designed for IFAs and RIAs.

Key Features

● Real-time portfolio and transaction management

● AI analytics for SIP tracking and rebalancing

● Business dashboard for AUM, commissions, and performance

● CRM with automated alerts and follow-ups

Why Investwell Mint Works Well

If analytics and organised client management are central to your service model, this platform supports data-driven decisions.

Best suited for:

MFDs who rely on analytics and CRM workflows.

5. theMFBox (by AdvisorKhoj)

theMFBox combines back-office support with research-driven advisory tools.

Key Features

● Back-office operations and compliance support

● AdvisorKhoj research tools and calculators

● Client portfolio monitoring

● Goal-based and performance reports

● Customisable advisory tools

Why theMFBox Works Well

If your service approach is research-focused, this platform helps you deliver deeper insights to investors.

Best suited for:

MFDs who prioritise research-backed advisory.

6. AssetPlus

AssetPlus is also recognized as a digital growth platform for MFDs.

Key Features

● Digital onboarding and eKYC

● Research and analytics tools

● Regular training and business development programs

● Mobile-friendly investor access

Why AssetPlus Works Well

If you want software plus business growth support, AssetPlus offers a broader scope.

Best suited for:

MFDs focused on client acquisition and digital growth.

7. ZFunds

ZFunds is a popular, cost-effective software platform.

Key Features

● Tracks investments across multiple AMCs

● Handles SIPs, SWPs, redemptions, and switches

● Portfolio analytics and customisable reports

● CRM features and reminders

● SEBI & AMFI compliance updates

● Mobile accessibility

Why ZFunds Works Well

It offers a solid mix of features at an affordable price point.

Best suited for:

Small to mid-sized MFDs looking for value-for-money software.

8. FundzBazar

FundzBazar is another platform backed by Prudent Corporate.

Key Features

● Investor reporting and dashboards

● Compliance and KYC support

● Digital onboarding and transaction processing

● Access to multiple investment products

Why FundzBazar Works Well

If you want a structured, execution-focused platform supported by an established institution, FundzBazar fits well.

Best suited for:

MFDs who prefer stability and structured transaction workflows.

Final Takeaway

Choosing MF software in 2026 is not about ticking feature boxes. The right platform helps you reduce daily operational stress, stay compliant without constant follow-ups, communicate better with investors, and focus on scaling AUM and business growth.

The best software is the one that fits your business model today and supports where you want to go next.